Transform Financial Services with AI Journeys

Leverage pre-built conversational journeys to automate interactions across customer service, sales and advisory - securely and at scale

Trusted by leading consumer brands globally

Onboard new customers digitally

Allow customers to discover products on popular channels like WhatsApp

Minimize abandonments by replacing 'form filling' and document collection with the ease of chat

Complete KYC, onboard and activate customers using message, voice and video

Lower Onboarding time

Grow relationship value with easy transactions

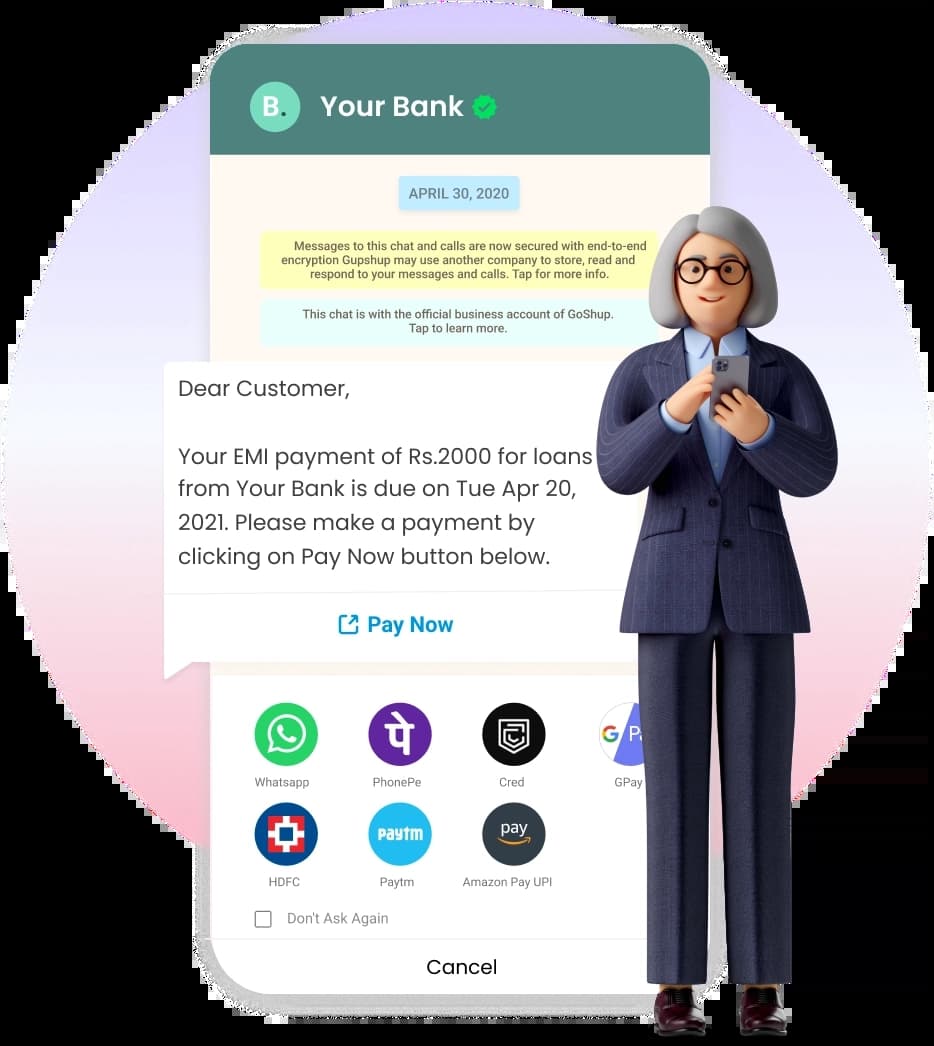

Let customers pay EMIs, premiums, buy stocks and make deposits over chat

Improve conversion of payment messages with WhatsApp native payments

Encourage action with alerts, portfolio advice, tailored offers and comparisons

Higher upsell & cross-sell revenue

Optimize costs and serve better with intuitive support

Reduce customer wait time with automated FAQs & pre-built journeys

Humanize the experience with text, voice & video based interactions for complex queries

Predict better with AI and aid Relationship Managers to cultivate profitable relationships

Queries handled without human intervention

4 Bn+

BFSI Interactions

per month

97%

AI accuracy in

query responses

50%

Increase in Click-to-Payment ratio

Unmatched capabilities

Omnichannel Finance

Integrate with 30+ messaging channels through Text, Voice, and Video to deliver a superior banking experience

WhatsApp Banking

Offer 24*7 access on customer's favourite messaging channel across 180 countries

Voice and Video

Incorporate Voice & Video AI into every customer touchpoint, inbound & outbound calls, IVR, voice notes and assistants

WhatsApp native payments

Allow customers to make easy payment to bills, EMIs, and other purchases right from the chat screen

Digital eKYC

Simplify KYC with guided flows and online document collection. Reduce effort and drop offs with anytime video KYC

AI Assistant

Provide a personal assistant that speaks the customer's language with secure, natural conversational experiences for mobile and web

Transform customer experience with out-of-the-box journeys and templates

Create a dynamic banking experience with 150+ prebuilt journeys connecting many different core, payment and financial systems across banking, insurance, capital markets and payments.

Build the next-gen brokerage with journeys for stock quotes, market information, portfolio, orders, equities and mutual funds.

Make the experience seamless with pre-built journeys for claims processing, policy management, premium payments and service requests.

Lift the payment experience with support for mobile recharge, subscription renewals, utility bill, incorrect debit reversals and payment failures.

Increase engagement with credit union members on conversational apps and intelligently cross-sell, up-sell and care for your customers 24/7, in the language of their choice

Integrate quickly with apps and platforms you already use

Frequently Asked Questions

Through Conversation Builder, no-code AI/ low-code platform, businesses can build intelligent experiences to deliver rich, personalised content and meaningful interactions. These can be around lead generation and qualification, cross-sell and upsell, KYC processes, collections and more.