Tonik Bank Transforms Banking Experience with Gupshup Gen AI Conversations, Automating Resolution of 75% of Customer Queries

By automating conversations, Philippines’ digital-only neobank expects to save USD 20 million in operational costs over the next three years.

$20 mn

expected cost saving in 3 years

95%

AI accuracy

4.3X

higher customer care productivity

Client Speak

The Story & Challenges

Tonik Bank, one of the leading digital-only neobanks in the Philippines, offers a range of loan, deposit, and payment products through a highly secure digital banking platform. With a rapidly growing customer base of 1.5 million, Tonik experienced a remarkable 2.5X increase in customer interactions. While maintaining high service quality remained a top priority, scaling operations efficiently became a challenge. The bank needed a solution that could keep pace with its expanding customer base without significantly increasing operational and contact center costs.

The Solution

To tackle these challenges, Tonik partnered with Gupshup to integrate Generative AI into its customer service chatbot. This collaboration led to the deployment of Gupshup’s advanced conversational AI, which handles customer queries autonomously via Tonik’s in-app chat.

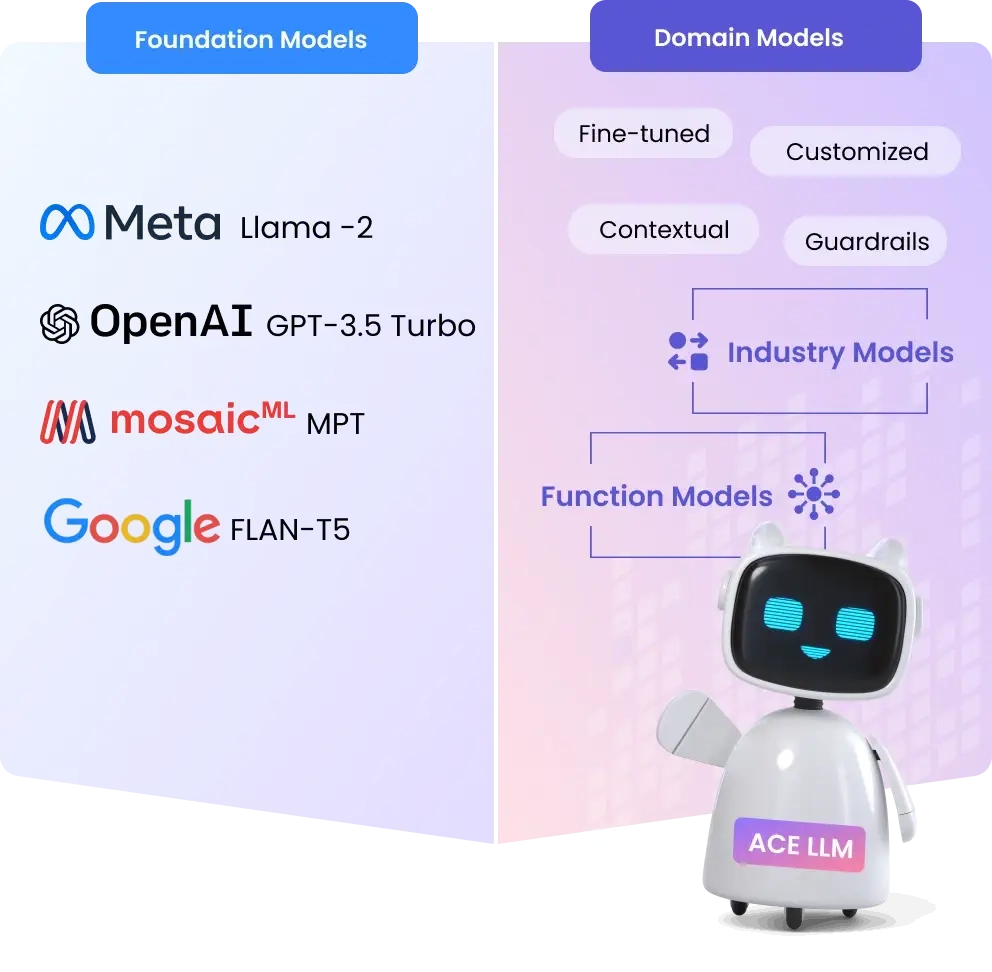

Previously, Tonik relied on an NLP and NLU-based chatbot that automated some queries but required continuous training — especially as product information and features frequently changed. To improve AI accuracy, reduce manual retraining, and ensure customers received the most up-to-date information, Gupshup proposed a multi-model approach. This approach combined Gupshup’s fine-tuned ACE LLM (built atop foundational models) with traditional NLP models, optimizing for latency, response quality, and cost-effectiveness.

As a result, the chatbot now autonomously resolves 75% of customer queries, covering a wide range of topics from FAQs about account opening and to information about our loan products. This significantly reduces the need for human intervention. The hybrid AI approach also minimizes the need for constant retraining by allowing the chatbot to directly utilize information from the bank’s website and policy documents. Additionally, ACE LLM’s fine-tuning reduces AI hallucinations, ensuring high accuracy and reliability.

Results

The integration of Gupshup ACE LLM has led to significant improvements in Tonik Bank’s operations and customer service. The productivity of the in-house customer care team increased by 4.3 times, allowing them to focus on more complex issues. Customer query management became more efficient, with nine out of ten queries being handled through the in-app chat and achieving an AI accuracy rate of 95%.

This initiative is expected to save over USD 20 million in operational costs over the next three years, contributing to a significant increase in productivity while maintaining a headcount growth rate below 20%.

Ready to get started on your conversational banking journey?

As an AWS ISV Accelerate partner, Gupshup handles massive traffic, with millions of messages sent monthly. Leveraging services like Bedrock helps scale Generative AI models and achieve efficient computing resource management. Benchmarking various models including Llama (7B, 13B), Mistral, and those from AI21 and Claude enables optimized infrastructure and scalable conversations.